2024 Ad Upfronts: Key Takeaways and Recommendations

It’s Upfronts season, the decades-old practice of buying and selling TV advertising in advance. Historically, these deals occur in the spring and cover the upcoming TV broadcast year. However, the landscape is evolving with the shift from linear TV to streaming platforms like Netflix and Amazon, which are now significant players in this space.

Here are Backbone’s key takeaways from major platforms and traditional networks:

Amazon:

TLDR; Amazon claims it is now the largest ad-supported streaming service in the world, reaching 115 million people in the United States. The platform promised one ad platform for everyone—regardless of whether a brand sells on Amazon—that would serve as a comprehensive solution for brands to connect with shoppers via data, ad tech, TV shows, and movies. Amazon also mentioned Prime Video, which launched ads earlier this year, now has Shoppable, pause, and trivia ad formats, and advertisers will be able to link these ads to their retail catalog and have direct check-out capabilities.

Backbone’s POV: Backbone has been using the Amazon Demand-Side Platform (DSP) and is particularly excited about the ability to target Prime Video. The introduction of new video ads signifies Amazon's shift from traditional ads to more high-impact, attention-grabbing formats.

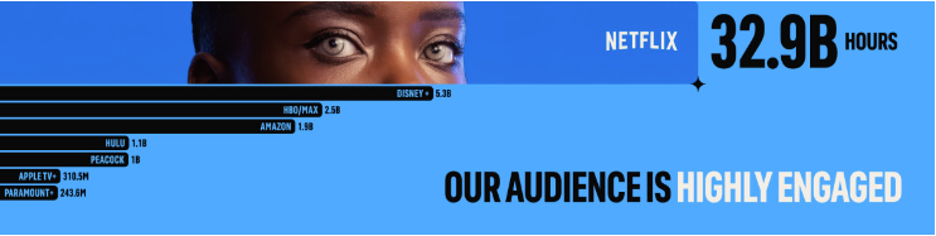

Netflix:

TLDR; Netflix boasts 40 million+ active users on its ad tier and touted several new features. First, they are taking their ad tech in-house to better control sales and measurement; the platform is set to launch at the end of 2025. In addition, the platform will air its first live NFL game this Christmas (with more to follow). Finally, Netflix is expanding its buying capabilities to include The Trade Desk, Google's DV360, and Magnite, who will join Microsoft as the main programmatic partners for advertisers.

Backbone’s POV: This expansion will allow more brands and marketers to access Netflix inventory, since there will be a larger variety of options to buy through. The Trade Desk is Backbone’s preferred DSP, so now having access to Netflix inventory to gain insights into the platform’s users and optimize our targeting strategies is exciting. For advertisers not using TTD, there are also access points through DV360 and Magnite, meaning Netflix will be buyable similar to traditional networks like Disney and Peacock.

Google:

TLDR; First, Google introduced new features to simplify the transaction processes for CTV programmatically. In terms of new tools from the platform, the first, which will live within DV360 (Google’s DSP), will make it easier to access premium streaming inventory digitally—this expands on its instant deal tool, which allows buyers to run private auctions for publishers like Disney, and will help buyers secure quality inventory and skip negotiations. Another tool they unveiled, the ‘Commitment Optimizer’, will help brands manage their deals within DV360 with the use of AI, which will optimize the best mix of inventory across all deal types. The final tool Google announced, which will also live within DV360, will prompt marketers to describe their intended customer base and Google AI will build matching audiences beyond who the marketer might have originally conceived.

Backbone’s POV: These new tools are making DV360 more competitive with other DSPs that already offer similar features, such as The Trade Desk.

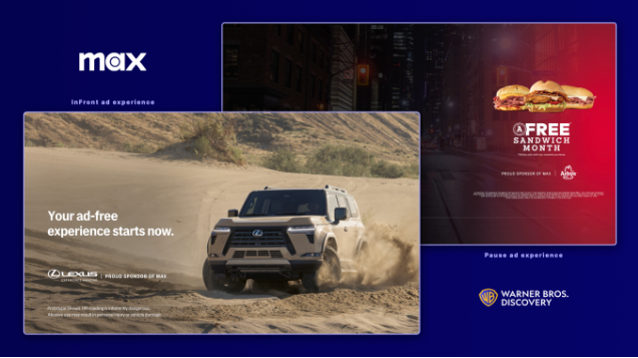

Warner Brothers/ Discovery:

TLDR; The platform unveiled fresh ad formats set to arrive on Max. These options will link TV marketing efforts with tangible business results and purchase measurement. Similar to Amazon, one of these new ad formats is shoppable ads that will allow viewers to browse featured products during commercial breaks. Other interactive units coming to Max include trivia ads, choosing between ads based on subject preferences, and ads where viewers can have more information about a product emailed to them. In addition, WBD is adding a new contextual targeting option to target ads by the emotional tone or specific elements within a scene (and is a more advanced option for advertisers to use beyond audiences). Right now, these ad formats are only available via direct buy but will hopefully be rolling out to Programmatic Guarantee (PG) and Private-Marketplace (PMP) within the next year.

Backbone’s POV: Although these new ad formats are currently only available through direct buys, they indicate a shift in the CTV space towards high-impact, shoppable units. The upcoming contextual targeting option will be a game changer, enabling ads to better align with the content the user is watching.

Fox:

TLDR; Jeff Collins, who was named Fox’s Ad Chief in January 2024, touted Fox’s ad innovations such as the implementation of Tubi’s ad tech for serving ads across Fox’s assets. Further, the new ad tech platform, AdRise, allows advertisers to more easily buy inventory across Fox’s digital and linear assets. Fox also highlighted Tubi to target Gen Z viewers, offering a distinct opportunity compared to many of its other segments. Finally, Fox introduced its partnership with Amazon to implement consumer data and shoppable ad formats in its content.

Backbone’s POV: Fox’s positioning towards a younger, Gen Z audience with Tubi is a unique opportunity to test creative messaging within CTV assets. It will also be interesting to explore how to buy and execute Amazon consumer data with Fox, as Amazon traditionally keeps their data only accessible via their DSP.

Roku:

TLDR; Roku showcased its support for brands by offering unmatched reach, groundbreaking creative experiences, and more. The platform announced a new data-driven TV streaming partnership with The Trade Desk and plans to empower advertisers using TTD to leverage Roku Media and audience and behavioral data to better understand and optimize campaigns for TV streaming viewers. This partnership grants traders in TTD access to audiences while also providing access to The Roku Channel inventory and Roku's automatic content recognition (ACR) data.

Backbone’s POV: The integration of the largest smart TV operating system with The Trade Desk’s buying platform will enhance traders' capabilities in planning, buying, and measuring TV streaming media. Roku's shift away from just selling on their OneView buying platform will grant more traders access to their data, including the Roku channel and audience network.

In a Nutshell:

The addition of Inventory access points and new ad unit formats will expand the options for brands and marketers to diversify their CTV campaigns and reach their audiences. The expanded inventory will also create more access to high-quality content, which has shown to be more effective in Increasing brand recall and intent. Additionally, as brands expand from traditional TV ads to shoppable units that are now available, CTV has the chance to be effective further down the consumer journey and closer to the point of conversion. This will make It more competitive with other channels like Display, Native, and Social when advertisers have strong ROAS goals.

The Backbone team is excited to explore many of the new opportunities across platforms and publishers in 2024!

Please reach out to info@backbone.media for more information.